About the Program:

This is a comprehensive classroom programme on knowledge of technical analysis, to

understand the strengths of technical analysis. After having in depth knowledge of technical

analysis and learning practical implications during this programme a learner will be able to

build his/her own trading strategies for intraday as well as positional trades. Advanced

technical tools will help the trader become more confident as he/she will be able to predict the

trends and patterns of stock price.

Suitable for:

¶ Students

¶ Stock Analysts

¶ Finance Professionals

¶ Employees with financial service sector.

¶ Anybody having interest in this subject

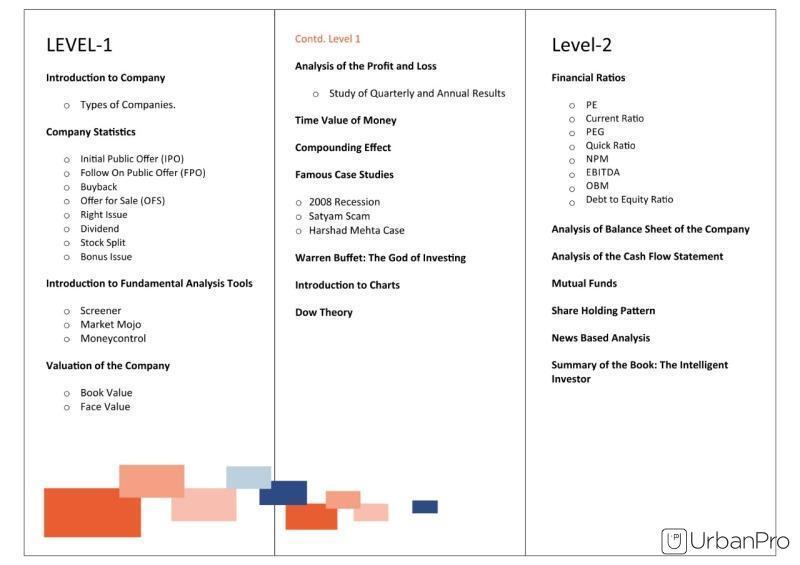

Programme content:

INTRODUCTION TO TECHNICAL ANALYSIS

1.1 What is technical analysis?

1.1.1 Price discounts everything

1.1.2 Price movements are not totally random

1.1.3 Technical Analysis: the basic assumption

1.1.4 Strengths and weakness of technical analysis

1.1.4.1 Importance of technical analysis

1.1.4.2 Weaknesses of technical analysis

CANDLE CHARTS

2.1 The charts

2.2 Candlestick analysis

2.2.1 One candle pattern

2.2.1.1 Hammer

2.2.1.2 Hanging man

2.2.1.3 Shooting star and inverted hammer

2.2.2 Two candle pattern

2.2.2.1 Bullish engulfing

2.2.2.2 Bearish engulfing

2.2.2.3 Piercing

2.2.2.4 Bearish harami

2.2.2.5 Bullish harami

2.2.3 Three candle pattern

2.2.3.1 Evening star

2.2.3.2 Morning star

2.2.3.3 Doji

PATTERN STUDY

3.1 What are support and resistance lines

3.1.1 Support

3.1.2 Resistance

3.1.3 Why do support and resistance lines occur?

3.1.4 Support and resistance zone

3.1.5 Change of support to resistance and vice versa

3.1.6 Why are support and resistance lines important?

3.2 Head and shoulders

3.2.1 Head and shoulders top reversal

3.2.2 Inverted head and shoulders

3.2.3 Head and shoulders bottom

3.3 Double top and double bottom

3.3.1 Double top

3.3.2 Double bottom

3.3.3 Rounded top and bottom

3.4 Gap theory

3.4.1 Common gaps

3.4.2 Breakaway gaps

3.4.3 Runaway/continuation gap

3.4.4 Exhaustion gap

3.4.5 Island cluster

MAJOR INDICATORS & OSCILLATORS

4.1 What does a technical indicator offer?

4.1.1 Why use indicator?

4.1.2 Tips for using indicators

4.1.3 Types of indicator

4.1.4 Simple moving average

4.1.5 Exponential moving average

4.1.6 Which is better?

4.2 Trend following indicator

4.2.1 When to use?

4.2.2 Moving average settings

4.2.3 Uses of moving average

4.2.4 Signals - moving average price crossover

4.2.5 Signals - multiple moving averages Oscillators

4.3.1 Relative strength index

4.3.1.1 What is momentum?

4.3.1.2 Applications of RSI

4.3.1.3 Overbought and oversold

4.3.1.4 Divergence

4.3.1.5 Stochastic

4.3.1.6 William %R

4.3.1.7 Real life problems in use of RSI

4.3.1.8 Advanced concepts

4.3.2 Moving average convergence/divergence(MACD)

4.3.2.1 What is the MACD and how is it calculated

4.3.2.2 MACD benefits

4.3.2.3 Uses of MACD

4.3.2.4 Money Flow Index

4.3.2.5 Bollinger Bands

4.4 Using multiple indicators for trading signals

4.4.1 Price sensitive technique

4.4.2 Volume sensitive techniques

4.4.3 Composite methods

4.4.4 How to use tool kit of trading techniques

4.4.5 Trading market tool kit applications

4.4.6 Bull market tool kit application

4.4.7 Bear market tool kit application

4.4.8 Trading market changing to bull market tool kit application

4.4.9 Trading market changing to bear market tool kit application

4.4.10 Bull market changing to trading market tool kit application

4.4.11 Bear market changing to trading market tool kit application

TRADING STRATEGIES

5.1 Day trading

5.1.1 Advantages of day trading

5.1.2 Risks associated with risk day trading

5.2 Strategies

5.2.1 Strategies for day trading

5.2.2 Momentum trading strategies

DOW THEORY AND ELLIOT WAVE THEORY

6.1 Introduction

6.2 Principles of Dow Theory

6.3 Significance of Dow Theory

6.4 Problems with Dow Theory

6.5 Elliot Wave

6.5.1 Introduction

6.5.2 Fundamental Concept

6.5.3 After Elliott

TRADING PSYCHOLOGY AND RISK MANAGEMENT

7.1 Introduction

7.2 Risk Management

7.2.1 Components of risk management

7.2.1.1 Stop loss

7.2.1.2 Analyze reward risk ratio

7.2.1.3 Trail stop loss

7.2.1.4 Booking Profit

7.2.1.5 Uses of stop loss

7.2.1.6 Qualities of successful trader

7.2.1.7 Golden rules of traders

7.2.1.8 Do's and don'ts in trading

7.3 Rules to stop losing money

7.4 Choosing the right market to trade

7.4.1 Importance of discipline in trading

Programme highlights:

Practical applications on real market data. Utilise derivative strategies with technical strategies.

Able to prepare technical research reports. Able to prepare daily basis reports. Create your own

market forecast. Identify trends and important price patterns. Recognize patterns. Use technical

indicators. Apply technical theories.

Duration of the programme:

30 Days

Programme Fee: 15000/-

Fee includes Registration fee, notes, books, software for technical analysis.