About the Program:

This is a comprehensive classroom programme on knowledge of fundamental analysis, to understand the strengths of company analysis, industry analysis, economy analysis. Fundamental analysis is a stock valuation methodology arrived at by performing security analysis. An appropriate security analysis forms the basis of successful investment decisions. This module aims at providing a basic insight about fundamental analysis and various valuation methodologies used.

Suitable for:

- Students of management and commerce

- Stock Analysts

- Finance Professionals

- Employees with financial service sector.

- Anybody having interest in this subject

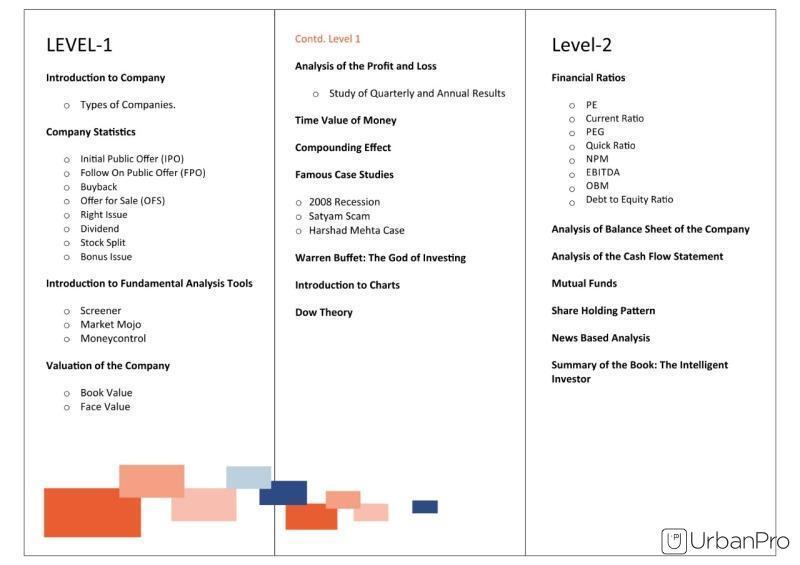

Programme content:

Introduction

- Types of companies

- Initial Public Offer (IPO)

- Efficient Market Hypothesis

- Equity-Holding Pattern Analysis

- Concept of â??Time Value of Moneyâ??

Mind-set of an Investor

- Speculator vs Trader vs Investor

- The compounding effect

- Does investing work?

Six Corporate Actions

- Dividend

- Bonus Shares

- OFS

- Stock Split

- Rights Issue

- Buyback of shares

Company Analysis

- Understanding the Balance sheet

- Profit & Loss Statement

- Financial Statements

- Cash Flow Statement

- Analysis of Quarterly Results

- News based Analysis

- Price / Earnings Ratio

- Price / Book Value Ratio

- EBITDA Ratio

- PEG Ratio

Financial Ratios

- Profitability Ratios

- Leverage Ratios

- Operating Ratios

- Valuation Ratio

- Index Valuation

Top-Down Valuation

- Economy

- Industry

- Company

Portfolio Management

- Stock Price vs Business Fundamentals

- Equity Research

- DCF Analysis

- Systematic Investment Planning

- Value Investing

- The Beta

- Margin of Safety

- Portfolio Diversification

Programme highlights:

Fundamental analysis can help uncover companies with valuable assets, a strong balance sheet, stable earnings, and staying power. Learner will be able to identify and predict long-term economic, demographic, technological or consumer trends. This will allows investors to develop an understanding of the key value drivers and companies within an industry. Key highlight of this program is portfolio diversification and systematic investment planning.